The concept of mixing bitcoins dates back to at least 2010 when Bitcointalk and various online communities started discussing the need for improved privacy features. The first Bitcoin mixer, known as Bitcoin Laundry (also called BitLaundry), is believed to have been launched around this time. Bitcoin Laundry allowed users to hide their funds by sending bitcoins to the service and receiving other bitcoins forwarded from the service.

The first bitcoin mixer to make use of blind signatures was called Blindbitcoin, announced on June 2011. Blind Signatures are a cryptographic process created by David Chaum which hide the contents of a message before it is signed with a digital signature such as DSA, or ECDSA in the case of Bitcoin. The idea for mixers to use variable fees was proposed on June 2012, around the same time the first mixer hack occurred (and the second).

We keep a dedicated blind signatures explainer for readers who want the full Chaumian credential story.

Ironically, that mixer started a claims page, which directed users to perform identity verification to receive their funds back. Don’t ask me how it got to that. Such a thing would be unspeakable in the present day. Even Blockchain dot com was running a mixer at the time (surprise!).

Also it should be noted that the bitcoin mixer list does not have any of these mixers listed because they appear to have been taken offline a long time ago, but by their owners at least, not any government.

If you want to compare those early services with today’s custodial offerings, head over to the centralized mixers overview.

The Use Of CoinJoin By Bitcoin Mixers

An in-depth breakdown of CoinJoin wallets, fees, and risks now lives on CoinJoin Mixing Explained. This section remains as a quick reminder of how the concept emerged.

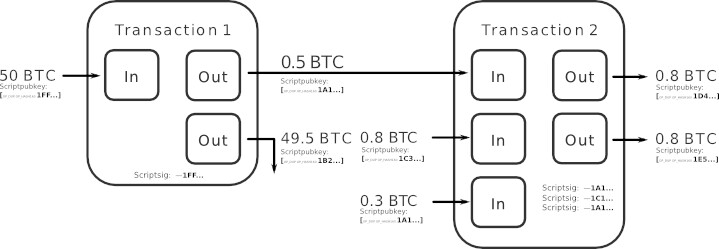

Over time, as the demand for privacy solutions increased, more Bitcoin mixers entered the scene. They offered different algorithms and methodologies to break the link between the sender and the receiver of bitcoins. Some mixers focused on implementing CoinJoin (a technique created by former Bitcoin Core developer Greg Maxwell), which combines multiple transactions into a single transaction, while others adopted different techniques to achieve the same goal.

To give you an idea of the theory that makes CoinJoin work, here is a description from Greg Maxwell himself.

“The signatures, one per input, inside a transaction are completely independent of each other. This means that it’s possible for Bitcoin users to agree on a set of inputs to spend, and a set of outputs to pay to, and then to individually and separately sign a transaction and later merge their signatures. The transaction is not valid and won’t be accepted by the network until all signatures are provided, and no one will sign a transaction which is not to their liking.”

Greg Maxwell

The independence of transaction inputs is why CoinJoin works at all—but instead of retelling the engineering details here, we point readers to CoinJoin Mixing Explained for current wallets, PSBT workflows, and threat models.

Fragility of Early Mixers

Those early services were fragile—many stored user funds on Mt. Gox, disappeared when admins lost interest, or flat-out scammed customers. The centralized mixers overview explains how modern custodial mixers solved those operational problems with proper liquidity management and multi-sig vaults.

LocalBitcoins And The Beginning Of Private Exchanges

When LocalBitcoins opened in June 2012, it was the first peer-to-peer marketplace of its kind. In a way, it was a precursor of the private exchanges as we know them today. Why is this important, you ask? Because in a private exchange, the buyer and seller directly trade cryptocurrencies with each other. Also fiat currencies could be traded, but that is beyond the scope of this website.

Way back then, people trusted each other enough to do direct trades on forums. When PayPal banned bitcoin sales, LocalBitcoins became the template for the second wave of private exchanges that mixers rely on today.

Early Blacklisting of Bitcoins By Companies

By 2015 payment processors like BitPay started declining coins linked to mixers, signalling the rise of exchange freezes and chain-surveillance outsourcing. We cover the modern version of those tactics (and how to respond) in Exchange Freezes After Mixing.

Attempts To Codify Mixers Into Bitcoin

In the years after Mt. Gox collapsed, several community members floated proposals to embed mixing directly into the Bitcoin reference client. One notable thread by Casascius described a relay where wallet-enabled nodes exchange their list of UXTOs and automatically craft CoinJoin transactions that both parties sign and broadcast. If Bitcoin Core developers had implemented something like it, nobody would need separate mixers because every wallet could shuffle coins on demand. In practice, the idea never gained steam—partially because SPV wallets, hardware devices, and KYC exchanges pushed privacy tooling to the edges, and partially because altcoins like Monero jumped at the chance to integrate ring signatures from day one.

The Rise Of Monero As An Alternative

Monero launched in April 2014 with built-in ring signatures, stealth addresses, and mandatory mixins derived from the CryptoNote whitepaper written by the pseudonymous Nicolas van Saberhagen. Ring signatures let a group sign a transaction without revealing which participant actually authorized it, giving Monero a level of default privacy that Bitcoin could only emulate via external tools. Despite a $625,000 IRS bounty to “break” Monero, chain-analysts have repeatedly failed to pierce its design, which is why it became the currency of choice on many darknet markets. Every time someone claims “Bitcoin is only for criminals,” point them to these unmaskings of Bitcoin mixers and remind them that Monero is where serious anonymization lives today.

JoinMarket and Practical CoinJoin Software

By early 2015, open-source developers launched JoinMarket, a wallet plus coordinator stack built atop libbitcoin that enables anyone to run maker bots and earn fees while helping takers CoinJoin. JoinMarket ships both CLI and Qt interfaces, is still actively maintained, and even supports PayJoin for two-party CoinJoins. Its popularity proved that privacy tooling could thrive outside Bitcoin Core and paved the way for Whirlpool and Wasabi to adopt similar patterns.